|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Without Closing Fees: A Comprehensive GuideUnderstanding No Closing Fee RefinancingRefinancing your mortgage can save you money, but closing costs often pose a significant barrier. Thankfully, refinancing without closing fees is an option worth exploring. This guide breaks down how you can take advantage of such opportunities. What Are Closing Fees?Closing fees are costs incurred during the refinancing process, including appraisal fees, title insurance, and lender fees. These can add up to thousands of dollars, making no closing fee options particularly attractive. Advantages of No Closing Fee Refinancing

Potential DrawbacksWhile refinancing without closing fees offers clear benefits, there are potential drawbacks to consider.

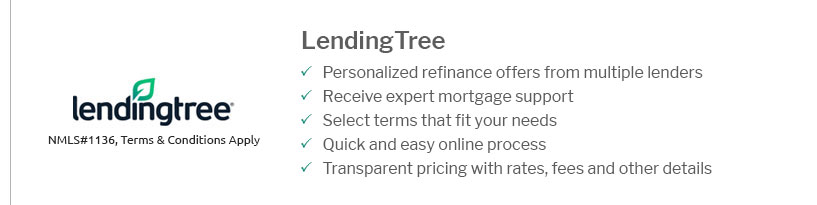

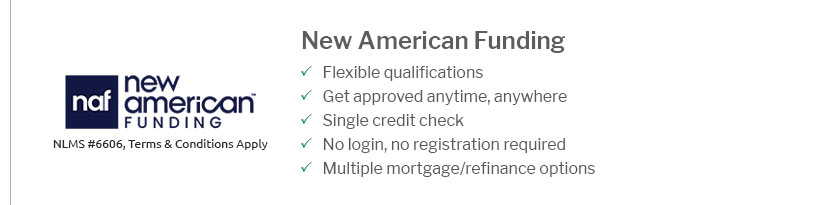

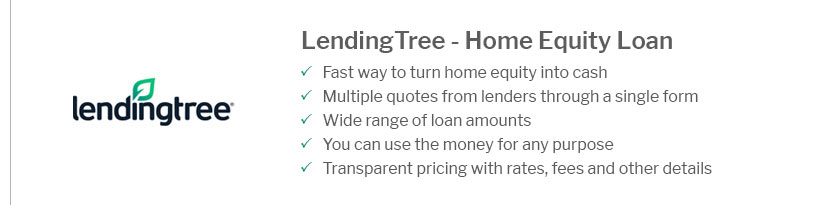

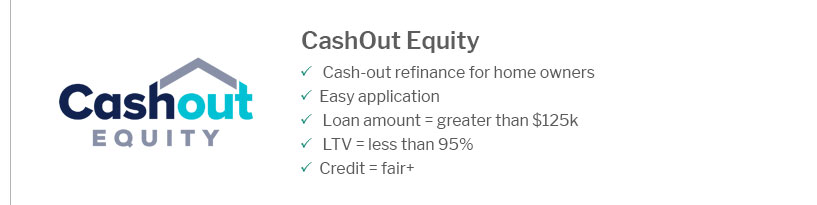

How to Qualify for No Closing Fee RefinancingGood Credit StandingA strong credit score is crucial. Lenders often reserve their best offers for borrowers with excellent credit. Research LendersIt's essential to compare different lenders. For those with a VA loan, exploring va loan mortgage rates can provide valuable insights. Alternatives to ConsiderIf no closing fee refinancing isn't feasible, other options like a Home Equity Line of Credit (HELOC) might suit your needs. Check out the best HELOC rates today for potential alternatives. FAQsWhat does no closing fee refinancing entail?No closing fee refinancing eliminates upfront costs like appraisal and title fees. However, lenders may charge a slightly higher interest rate to compensate. Are there any hidden costs in no closing fee refinancing?While there are no direct closing costs, be aware of potential trade-offs like higher interest rates or longer loan terms that could affect overall savings. How do I choose the right lender for no closing fee refinancing?Research multiple lenders, compare interest rates, terms, and conditions, and consider your financial goals. Online resources and reviews can guide your decision. https://www.lendingtree.com/home/refinance/no-closing-cost-refinance/

If you're outgrowing your home and plan to sell soon, a no-closing-cost refinance allows you to save money without having to recoup your costs. Just remember: ... https://www.miamiherald.com/banks/mortgage/refinance-mortgage-no-closing-costs/

A no-closing-cost refinance comes into play. As the name suggests, it allows you to refinance without doling out a hefty sum of cash to cover closing costs. https://myhome.freddiemac.com/refinancing/costs-of-refinancing

If your lender offers you a no-cost refinance, keep in mind there is no such thing as a free loan. They are probably charging a higher interest rate and ...

|

|---|